Contrax : Succès de la gestion des contrats clients en 2025

Pourquoi 65 % des entreprises échouent dans la gestion des contrats clients

Soyons honnêtes : la gestion des contrats clients n’est pas exactement le genre de sujet qui fait battre le cœur lors de la réunion d’équipe du lundi matin. Mais voici le hic lorsque 65 % des entreprises échouent, ce n’est pas seulement des maux de tête administratifs et de la paperasse égarée. C’est la perte de revenus, les relations tendues et les opportunités qui passent tranquillement entre les mailles du filet. Si vous vous êtes déjà retrouvé à chercher frénétiquement « ce contrat » ou à vous demander pourquoi les factures ne correspondent pas aux conditions convenues, vous n’êtes pas seul et vous n’imaginez certainement pas le chaos.

Alors, pourquoi tant d’organisations trébuchent-elles dans la gestion des contrats clients, et qu’est-ce qui distingue les plus performantes ? Entrons dans le vif du sujet, examinons les pièges et voyons comment des stratégies avancées et une technologie intelligente peuvent faire toute la différence.

Les pièges cachés de la gestion des contrats clients

Il est facile d’ignorer la gestion des contrats comme un mal nécessaire, un exercice de case à cocher pour garder les avocats heureux. Mais la réalité est beaucoup plus désordonnée. La gestion des contrats clients va de la négociation des conditions, du suivi des obligations, du suivi des renouvellements à la conformité. Et lorsque vous multipliez cela par des dizaines, des centaines, voire des milliers de contrats, la marge d’erreur augmente de façon exponentielle.

Le taux d’échec de 65 % : où les entreprises se trompent-elles ?

Une enquête récente a révélé qu’environ 65 % des entreprises admettent avoir échoué dans certains aspects de la gestion des contrats avec les clients. Mais à quoi ressemble réellement « l’échec » ?

Renouvellements et dates limites manqués : Les contrats expirent discrètement ou se renouvellent automatiquement à des conditions défavorables, simplement parce que personne ne surveille de près.

Perte de revenus : Les remises, les remises et les crédits de service ne sont pas réclamés ou sont mal appliqués, ce qui laisse de l’argent sur la table.

Documentation perdue : Les termes clés sont enfouis dans les traces d’e-mails, ou la seule copie signée est celle d’une personne qui a quitté l’entreprise.

Cauchemars de la conformité : Les obligations passent inaperçues ou passent inaperçues, ce qui risque d’entraîner des pénalités et d’endommager leur réputation.

Voyons pourquoi ces problèmes sont si courants.

Pourquoi tant d’entreprises éprouvent-elles des difficultés ?

1. Informations cloisonnées

Demandez à n’importe qui dans les ventes, la finance ou le service juridique où se trouve le dernier contrat client, et vous obtiendrez probablement trois réponses différentes et probablement trois versions différentes du contrat. Lorsque les informations sont éparpillées dans les boîtes de réception, les disques partagés et les classeurs poussiéreux, le chaos règne.

2. Processus manuels et erreur humaine

Les feuilles de calcul sont idéales pour suivre les dépenses ou votre ligue de football fantastique, mais elles sont un désastre pour la gestion de contrats clients complexes. La saisie manuelle entraîne des erreurs, des confusions de dates, des oublis d’obligations et des avis de renouvellement manqués.

Scénario : le renouvellement qui a coûté 100 000 £

Une entreprise de télécommunications de taille moyenne s’est appuyée sur Excel pour suivre l’expiration des contrats. Un contrat client clé s’est renouvelé automatiquement à un tarif obsolète simplement parce que personne n’a repéré la notification cachée dans une feuille de calcul. Au moment où ils se sont rendu compte, la fenêtre de renégociation s’était refermée, ce qui a coûté à l’entreprise plus de 100 000 £ de marge perdue.

3. Manque de visibilité et de rapports

Sans surveillance claire, il est impossible de gérer les risques, d’identifier les contrats sous-performants ou de repérer les opportunités de renouvellement à venir. De nombreuses entreprises ne peuvent même pas répondre aux questions de base : combien de contrats clients actifs avons-nous ? Lesquels doivent être renouvelés ce trimestre ? Qui est responsable de chacun d’eux ?

Impact dans le monde réel : panique de l’audit

Lors d’un audit de routine, une entreprise de services financiers a découvert que 20 % des contrats de ses clients ne disposaient pas de documents de conformité à jour. La recherche et la mise à jour de ces dossiers ont non seulement pris des semaines de temps de travail, mais ont également exposé l’entreprise à des amendes réglementaires.

À quoi ressemble le succès ?

Toutes les entreprises ne sont pas destinées à se débrouiller avec des délais manqués et des documents perdus. Les organisations les plus performantes considèrent la gestion des contrats clients comme une fonction stratégique, et non comme une réflexion après coup.

Caractéristiques d’une gestion efficace des contrats clients

Référentiel centralisé : Tous les contrats et documents connexes sont stockés dans un endroit accessible et sécurisé.

Alertes automatisées : Les dates clés, les obligations et les jalons sont suivis automatiquement, plus de mauvaises surprises.

Propriété claire : Chaque contrat a un propriétaire désigné responsable de son exécution et de sa conformité.

Flux de travail intégrés : Les équipes commerciales, juridiques et financières travaillent à partir du même ensemble d’informations, ce qui réduit les erreurs.

Ce ne sont pas des chimères, elles sont réalisables avec les bonnes stratégies et les bons outils.

Des stratégies avancées qui créent un avantage concurrentiel

Il ne s’agit pas seulement d’éviter le désastre ; Il s’agit d’utiliser la gestion des contrats clients pour obtenir un véritable avantage. Voici comment les grandes entreprises s’y prennent.

1. Les plateformes de contrats numériques : au cœur de la gestion moderne

Fini le temps où l’on fouillait dans les classeurs ou les fils de courriels interminables. Des plateformes comme Contrax Fournissez un hub numérique pour tous vos contrats, en les rendant consultables, sécurisés et toujours à jour.

Exemple pratique : Du chaos au contrôle

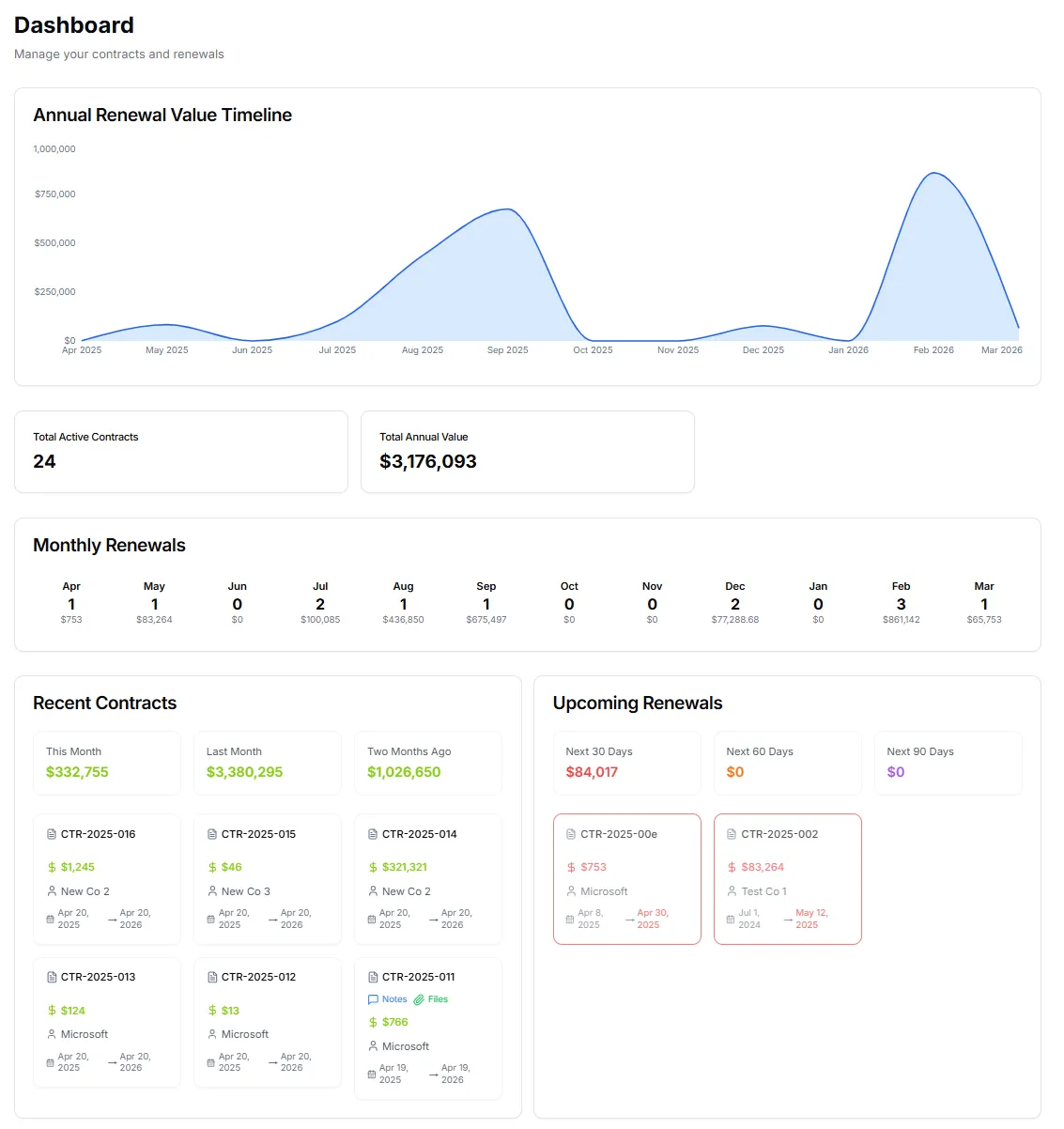

Une entreprise SaaS brésilienne est passée du suivi manuel à Contrax. Soudain, tous les contrats, nouveaux ou anciens, étaient à portée de main. Les renouvellements manqués appartenaient désormais au passé, et les rapports de conformité prenaient des heures au lieu de plusieurs semaines. L’équipe financière pouvait voir instantanément quels contrats nécessitaient une attention particulière, et l’équipe commerciale ne manquait jamais une occasion de renégocier les conditions.

2. Flux de travail et notifications automatisés

Imaginez ne plus jamais manquer une date de renouvellement ou une date limite de conformité. Grâce aux rappels automatisés et à l’attribution des tâches, les entreprises peuvent garder une longueur d’avance sur leurs obligations et saisir les opportunités de renégociation ou de vente incitative.

Comment Contrax aide

Contrax permet aux utilisateurs de configurer des alertes personnalisées pour chaque étape du cycle de vie d’un contrat, de la négociation au renouvellement. Si un contrat est sur le point d’expirer, les bonnes personnes en sont informées à l’avance. Si un client doit un crédit ou un examen de service, rien ne passe entre les mailles du filet.

3. Analyses et rapports en temps réel

Les meilleures plateformes ne se contentent pas de stocker des contrats, elles offrent des informations. Grâce à des tableaux de bord en temps réel, les entreprises peuvent rapidement identifier les tendances, repérer les accords sous-performants et prendre des décisions basées sur les données.

Cas d’utilisation : prise de décision basée sur les données

Une entreprise fintech utilisant Contrax a remarqué une tendance : plusieurs contrats clients incluaient des remises sur volume qui étaient rarement déclenchées. Grâce à ces informations, ils ont ajusté leur approche de vente et renégocié les conditions, ce qui a permis d’augmenter les revenus à tous les niveaux.

4. Collaboration transparente entre les équipes

Lorsque les ventes, le service juridique et la finance peuvent tous accéder aux mêmes enregistrements de contrat et les mettre à jour, les erreurs sont minimisées et l’efficacité augmente. Le contrôle de version garantit que tout le monde travaille à partir du document le plus récent, et les flux de travail d’approbation permettent de faire avancer les choses sans goulets d’étranglement.

Exemple : Clôtures d’affaires plus fluides

Un cabinet de conseil en ingénierie a été confronté à des retards dus à des contrats qui rebondissaient entre les départements pour l’approbation. Après avoir adopté Contrax, ils ont mis en place des flux de travail d’approbation automatisés. Les contrats ont progressé rapidement, accélérant la conclusion des contrats et libérant du personnel pour des tâches à plus forte valeur ajoutée.

Objections courantes : pourquoi les entreprises hésitent-elles à moderniser la gestion des contrats clients

Malgré les avantages évidents, certaines organisations résistent au changement. Abordons quelques-unes des objections habituelles.

« Nos contrats sont trop complexes »

Il n’y a pas deux contrats identiques, surtout dans des secteurs comme la technologie ou la construction. Mais les plates-formes modernes comme Contrax sont conçues pour gérer la complexité, prenant en charge des modèles personnalisés, des clauses variables et des approbations multipartites. Vous n’avez pas besoin de réduire les choses, il suffit de les rendre gérables.

« Nous sommes préoccupés par la sécurité des données »

La sécurité est une préoccupation légitime, en particulier pour les informations sensibles des clients. Contrax utilise un cryptage de niveau entreprise, des autorisations granulaires et des pistes d’audit détaillées, afin que vous sachiez exactement qui a accédé à quoi et quand.

« Le changement est trop perturbateur »

Le déploiement de nouveaux systèmes implique toujours des perturbations. La clé est de choisir une plate-forme avec des interfaces conviviales et un support robuste. Contrax, par exemple, offre une assistance à l’intégration, des ressources de formation et un support client afin que les équipes puissent être opérationnelles.

Au-delà de la technologie : créer une solide culture de gestion des contrats

Aucun outil, aussi sophistiqué soit-il, ne réparera les processus défaillants ou le manque de responsabilité. Voici ce qu’il faut d’autre pour vraiment exceller dans la gestion des contrats clients.

1. Politiques claires et propriété

Chaque contrat doit avoir un propriétaire désigné, c’est-à-dire une personne chargée de s’assurer que les obligations sont respectées et que les problèmes sont signalés. Les politiques doivent décrire qui peut négocier les conditions, signer des documents et approuver les modifications.

2. Formation et examens réguliers

Le personnel doit comprendre non seulement comment utiliser les outils, mais aussi pourquoi une bonne gestion des contrats est importante. Des sessions de formation régulières, le partage des connaissances et des post-mortems sur les litiges contractuels peuvent favoriser l’amélioration continue.

3. Adhésion de la direction

Lorsque la direction traite la gestion des contrats comme une priorité stratégique, elle donne le ton à l’ensemble de l’organisation. Des rapports réguliers au conseil d’administration ou à la haute direction aident à maintenir le rendement sur la bonne voie et à mettre en évidence les points à améliorer.

Étude de cas : redressement d’un portefeuille de contrats en difficulté

Regardons un véritable retournement de situation. Une société de services professionnels basée au Royaume-Uni était confrontée à des problèmes croissants : renouvellements manqués, litiges sur la portée et un sentiment général de confusion. Ils ont décidé de refondre leur approche de la gestion des contrats clients en trois étapes clés :

1. Centralisation de tous les contrats : Chaque contrat existant a été numérisé et téléchargé sur Contrax, créant ainsi une source unique de vérité.

2. Alertes automatisées : Les dates de renouvellement, les contrôles de conformité et les principaux livrables ont été suivis à l’aide de rappels automatisés.

3. Appropriation et responsabilisation : Chaque contrat a été attribué à une personne, et les performances ont fait l’objet d’un suivi au moyen d’examens réguliers.

Les résultats ? En six mois, le nombre de renouvellements manqués est tombé à zéro. Les litiges ont fortement diminué et l’équipe financière a identifié plusieurs contrats sous-performants à renégocier, débloquant des dizaines de milliers de dollars de revenus supplémentaires.

Étapes concrètes : Premiers pas avec la gestion moderne des contrats clients

Prêt à passer du chaos au contrôle ? Voici une feuille de route pratique :

1. Auditez vos contrats en cours : Identifiez où les contrats sont stockés, à qui ils appartiennent et lesquels sont sur le point d’être renouvelés ou expirés.

2. Identifier les risques immédiats : Recherchez la documentation manquante, les lacunes en matière de conformité ou les contrats aux conditions ambiguës.

3. Explorez les solutions numériques : Évaluez les plateformes comme Contrax pour des fonctionnalités telles que le stockage centralisé, les alertes automatisées, les analyses et les outils de collaboration.

4. Définir les rôles et les responsabilités : Attribuez la propriété de chaque contrat et décrivez les flux de travail pour la négociation, l’approbation et le renouvellement.

5. Formez votre équipe : Assurez-vous que tout le monde comprend à la fois les outils et l’importance d’une bonne gestion des contrats.

6. Surveiller et examiner : Mettez en place des contrôles réguliers pour examiner les performances des contrats, la conformité et les étapes à venir.

Conclusion : Transformer la gestion des contrats en une arme concurrentielle

La plupart des entreprises trébuchent sur la gestion des contrats clients, souvent parce qu’elles sous-estiment sa complexité ou qu’elles n’investissent pas dans les bons outils et processus. Mais avec la bonne stratégie et une plateforme comme Contrax, les entreprises peuvent transformer une source de frustration en un véritable avantage concurrentiel.

Au lieu de Lutte contre les incendies : délais non respectés et les litiges, vous bénéficierez d’une surveillance claire, d’un contrôle plus strict et de l’agilité nécessaire pour saisir de nouvelles opportunités. Dans un marché où la confiance et l’efficacité comptent plus que jamais, ce n’est pas seulement de l’entretien ménager, c’est aussi une bonne affaire.

Donc, si vous en avez assez de chercher ce contrat manquant ou de redouter le prochain cycle de renouvellement, il est peut-être temps de repenser votre approche. Avec des solutions modernes et un peu de détermination, la gestion des contrats clients peut passer du talon d’Achille à l’arme secrète.

Pour plus d’informations, visitez Contrax.cloud